13. December 2023

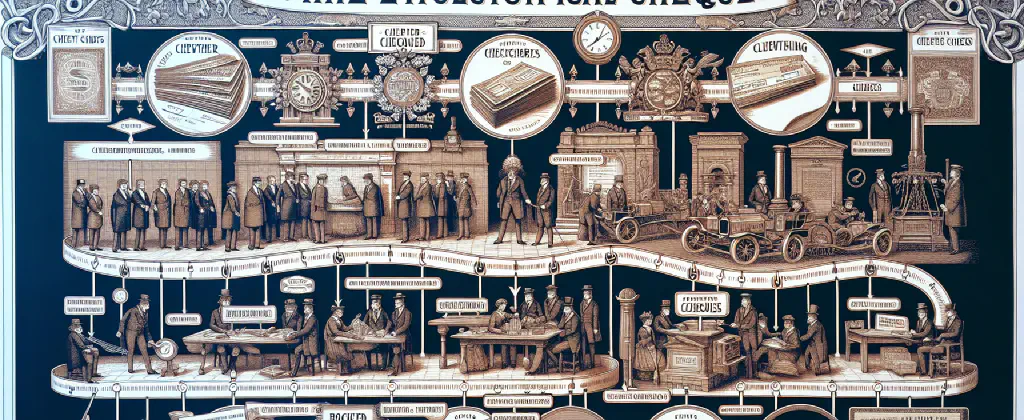

The Enduring Impact of Checks: From Uttering to Clearing

Checks have a long history and have shaped the way we handle financial transactions. From their origins as a means to reduce systemic risk, checks continue to have consequences in the modern world. In this article, we will delve into some key insights from user comments to explore the long shadow that checks cast.

Uttering: A Crime for “Charming Historical Reasons”

One user raised an interesting point about the crime of “uttering.” Uttering is the act of publishing or using a forged instrument, such as a check, with the intent to defraud. While the term may seem obscure, it has its roots in legal terminology. Uttering is synonymous with publication, and forgery is the fabrication of a forged instrument. The use of these terms highlights the distinction between making a fake check and actually using it with fraudulent intent[^1^].

Interestingly, the reason behind this specific terminology remains elusive. One commenter expressed curiosity about the “charming historical reasons” for this distinction, but no concrete sources or explanations were found. However, it was suggested that the distinction allows for the prosecution of both the forger and the one who uses the forgery, should they be different individuals[^3^].

The Delicate Balance of Writing Style

Another topic that emerged from the comments was the writing style of the author. Some users found it engaging and enjoyable, appreciating the author’s use of obscure words and literary devices. They saw it as an artifice that adds charm and intrigue to the content. However, there were also readers who found the style to be grating and difficult to follow. They expressed the need for clarity and simplicity in writing[^5^][^8^].

While different readers have different preferences, it is worth noting that the author’s particular style has garnered a significant following. Some even compared it to the well-known writer Matt Levine, who also has a unique way of making seemingly dry subjects interesting. The ability to transform complex topics into engaging content is a skill that captivates and educates readers[^11^].

Utterly Complex: The Clearing of Checks

The process of clearing a check may sound simple, but it is far more complex than it seems. The Uniform Commercial Code (UCC) plays a role in facilitating banks clearing each other’s checks, ensuring the smooth flow of funds. Clearing refers to completing the process agreed upon by the check writer, where the money leaves their account and enters the account of the check recipient. However, this process involves numerous steps and meticulous verification, making it more intricate than a quick gloss would suggest[^17^].

The Overdraft Conundrum

One user expressed curiosity about checking accounts that lack the ability to overdraft and create credit risk. Historically, overdraft fees have been a significant source of revenue for banks. However, there seems to be a shift in profitability, with overdraft fees becoming less lucrative. This trend, combined with increasing consumer awareness and alternative banking options, may lead to the phasing out of overdraft fees in the future[^20^][^21^].

Additionally, the nature of a checking account, even without the privilege of overdrafting, involves the potential credit risk for the bank or the check recipient. If the check writer does not have sufficient funds, the bank or check recipient bears the loss unless they pursue the check writer. On the other hand, debit cards offer more certainty, as the bank can verify the availability of funds before the transaction occurs[^23^].

The Impact Lives On

The impact of checks extends far beyond their initial purpose of reducing systemic risk. The nuances of vocabulary, the enduring writing style, and the intricacies of check clearing and overdrafting shape our financial landscape. While opinions may differ on writing styles and the usage of obscure words, the enduring legacy of checks continues to influence our daily interactions with money.

So, let us appreciate the long shadow of checks and the rich tapestry they weave in our financial systems. From uttering to clearing, checks are not just pieces of paper; they are a reflection of the delicate balance between trust, convenience, and financial security.